what is a secondary property tax levy

The secondary tax is. What is a Levy.

Mississauga Property Tax 2021 Calculator Rates Wowa Ca

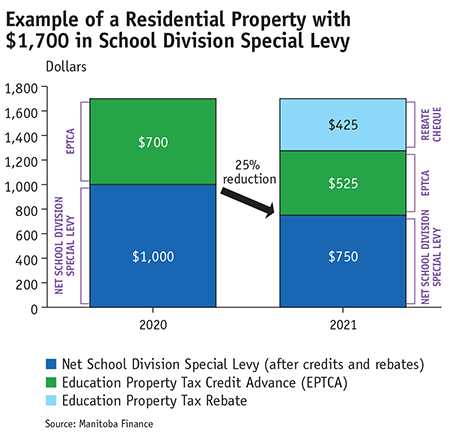

Residents then pay one-quarter of their full levy.

. 113 rows Property Tax Levies and Rates Use the telephone contact information in the table below to contact Taxing Authorities identified on your tax statement. 2 SECONDARY TAX RATES are used to fund such things as bond issues budget overrides and special district funding. The rates for the municipal portion of the tax are established by each municipality.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as security for a tax debt the levy takes your property such as funds from a bank account Social Security benefits wages your car or your home. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Levies are different from liens.

A municipal portion and an education portion. Secondary Property Tax Levy debt repayment. In other words the issue of whether to be taxed or not for a specific item went before voters in.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. A property tax levy is the right to seize an asset as a substitute for non-payment. The Arizona Constitution limits the total amount of primary property taxes that counties cities and community college districts can levy.

Therefore not paying your property taxes can result in the government seizing your property as payment. A Tax Levy is the amount of money to be raised by property taxation and is reported annually by each district residents approve the tax levy. Governments enforce a property tax levy as a measure of last resort.

Property tax is a tax based on ownership of a piece of real estate. A Tax Rate is is the percentage used to determine how much a property owner will pay per one hundred dollars of net assessed value. The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts.

A levy is a legal seizure of your property to satisfy a tax debt. Property tax is a levy based on the assessed value of property. The FY 2019-20 tax rate and levy were adjusted to fund new public safety and parks and cultural bonds approved by voters in November 2018.

Call 520 724-8341 or visit wwwtopimagov. The FY 202021 annual secondary property tax. The Pima County Treasurer can answer questions about HOW WHEN or WHERE to pay your taxes and how the money is invested.

Should you have other questions. EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax years. The secondary property tax is used to cover the annual debt service payments and related administrative feesexpenses.

The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located. Lesher is proposing a 19. A secondary property tax can only be used to pay back debt on voter-approved items.

A yes vote means voters agree to continue with a secondary property tax levy that amounts to an estimated 3686 per year or 018 cents per 100 of assessed value for a residential property owner. Failure to pay your property taxes can result in fines penalties interest and even the seizure of your property. The total of the Secondary Tax Rates and can be used to compute the Secondary Taxes by taking the Net Assessed amount from Limited Value of Dollars in the Assessment Box divided by 100 and multiplied by the total rate displayed in the Secondary Tax Rate Per 100 Assessed Value.

5 hours agoThe countys property taxes are composed of a primary tax that goes into the general fund and three secondary taxes for libraries debt services and flood control. In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to. FY 202021 Tax Levy chg.

A property tax levy is the right to seize an asset as a substitute for non-payment. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. 2020 2020 2020 PROPERTY TAX NET ASSESSED TAX LEVY TYPE LEVY VALUE RATE Operating Levy 640280922 45704969813 14009 Debt Service - 45704969813 00000 Flood Control District.

Levies are different from liens. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. The FY 202021 annual secondary property tax levy for the median-value City of Mesa residential property is 160.

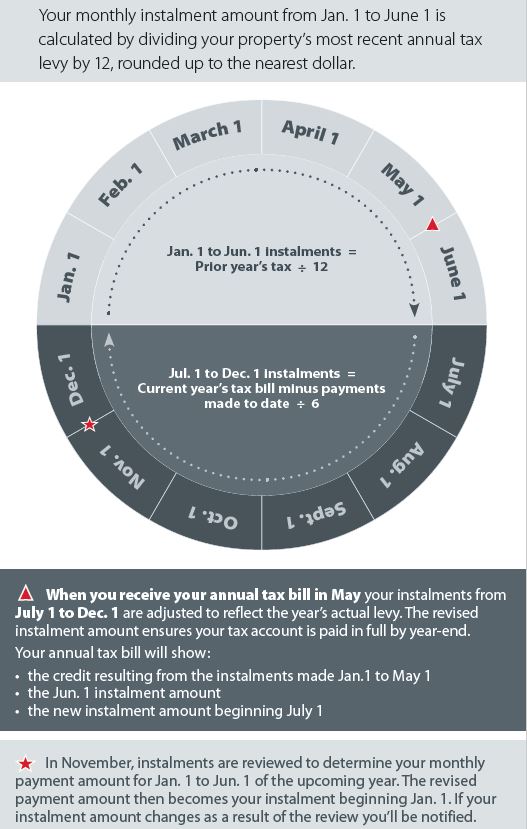

Another tax that is levied on property owners is a property tax which is. The second is a quarterly imposition where the tax authority divides each residents total yearly tax levy into four equal payments for the year. LEVY LIMITS HOMEOWNERS REBATE TAX DEFERRAL EXEMPTIONS.

For more information on assessed value and property tax see the Budget and Financial Summary. What is property tax. Where does Internal Revenue Service IRS authority to levy originate.

ESSB 6614 changed the rate based levy from 270 per 1000 market value to 240 per 1000 market value for the 2018 tax year. The IRS can use a levy to satisfy a tax debt. The secondary property tax levy resulting in the secondary property tax revenue is used to fund bonds which finance capital improvements.

The act of imposing a tax on someone is called a levy. Secondary Property Tax SEC. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt.

Property tax has two components. Only the amount necessary to make the annual payment of voter-authorize bonds are collected from the secondary property tax levy. Using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on all property.

A levied property tax is a tax imposed on property owners based on the value of their property and the municipal governments.

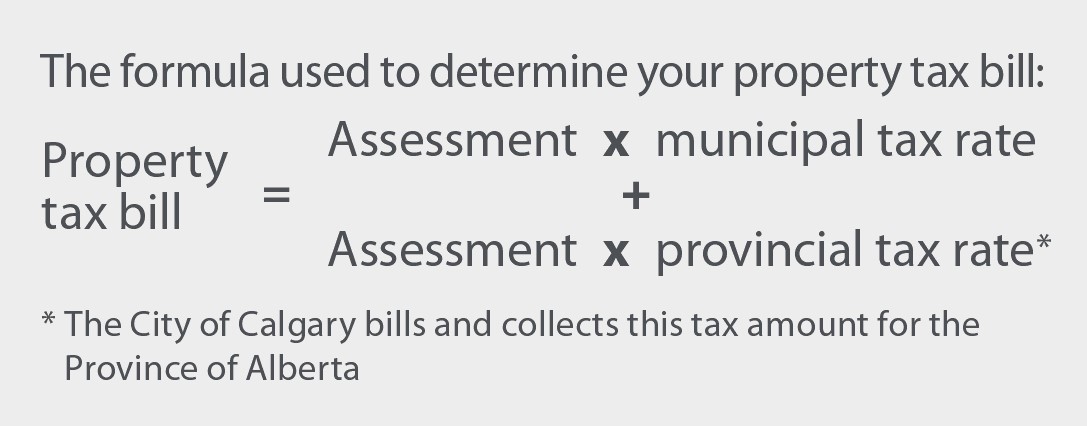

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

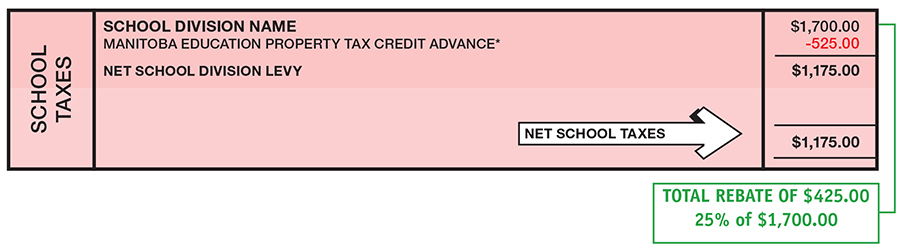

2021 Property Tax Bill Guide Rural Municipality Of St Clements

Understanding Your Property Tax Bill Town Of Lincoln

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

City Of Cranbrook Average 21 Increase In Residential Assessments Doesn T Translate Into A 21 Property Tax Increase For Local Homeowners

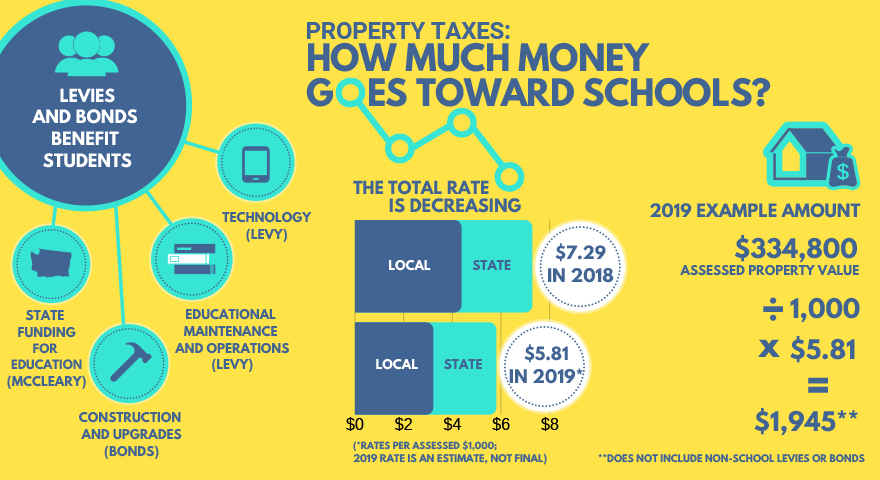

Property Tax Changes Vancouver Public Schools

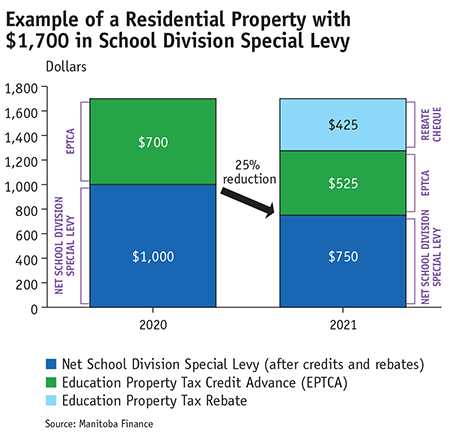

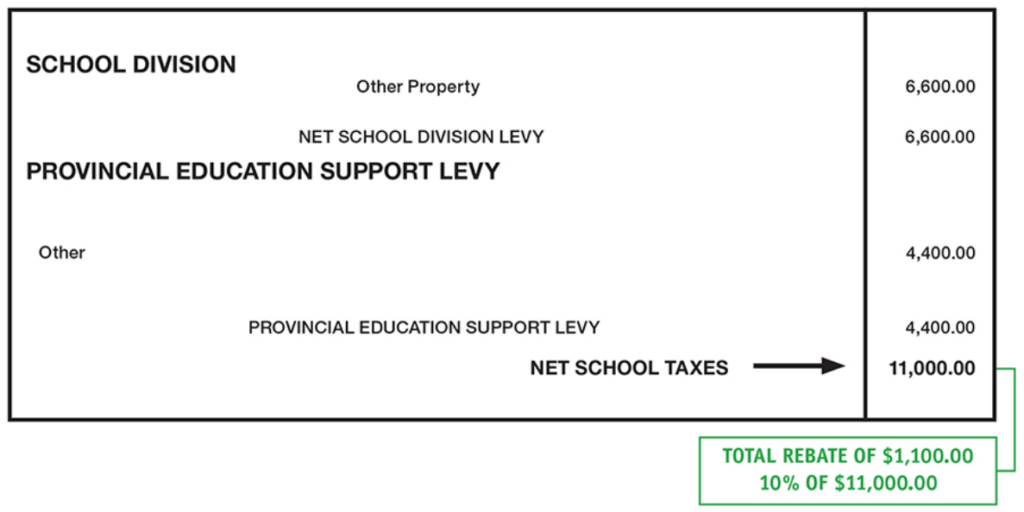

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

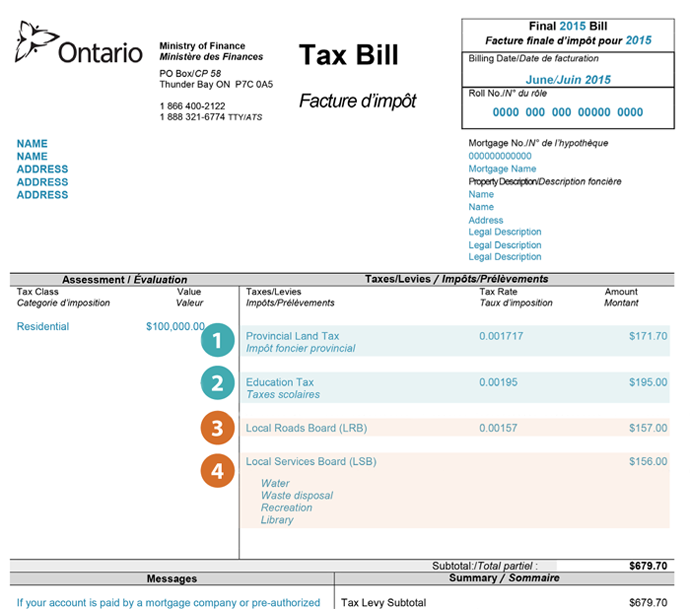

Understanding Your Property Tax Bill And The Services Supported Provincial Land Tax Ontario Ca

About Your Property Assessment Tax Rate And Tax Notice District Of North Vancouver

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

.jpg)