iowa state income tax calculator 2019

Your net income from all sources line 26 is 13500 or less and you are not claimed as a dependent on another persons Iowa return 32000 if you or your spouse is 65 or older on 123119. 1040EZ Tax Form Calculator.

Do I Need An Out Of State Attorney Dads Divorce Child Custody Spring Break Idioms

To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Fields notated with are required. After a few seconds you will be provided with a full breakdown of the tax you are paying.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Compare the amounts on line 4 and line 5.

This puts you in the 12 tax bracket. The Iowa tax calculator is updated for the 202223 tax year. See What Credits and Deductions Apply to You.

Enter other state and local income taxes not including Iowa state income taxes on line 4a OR general sales taxes on line 4b as allowed on the federal form 1040 Schedule A line 5a. Your average tax rate is 1198 and your marginal tax. Iowa Income Tax Calculator 2021.

The state income tax system in Iowa is a progressive tax system. Subtract line 2 from line 1. The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

For 2022 tax year. How to calculate Federal Tax based on your Annual Income. The tax brackets are the same regardless of your filing status and tax rates range from 033 to 853.

Rated 48 by 170 users on Verified Reviews. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the complexity of the full 1040 tax form. 2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax.

Home Tax Calculator 2019. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The median household income is 58570 2017.

Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. If you filed your return on time but did not pay at least 90 of the correct tax due by the due date you owe an additional 5 of the unpaid tax. These types of capital gains are taxed at 28 28 and 25 respectively unless your ordinary income tax bracket is a lower rate.

Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. You must calculate interest on the 500 and add it to the 550. Complete Edit or Print Tax Forms Instantly.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as. Long-term Capital Gain Tax Rates 2022. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

Income subject to alternate tax calculation. Your total unpaid tax and penalty is now 550. Iowa Paycheck Calculator.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. The Iowa income tax calculator is designed to provide a salary example with salary deductions made in Iowa. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

Multiply line 3 by 853 0853. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Nonresidents and Part-Year Residents.

Annual 2019 Tax Burden 75000yr income Income Tax. Status 3 and 4 filers. There is also additional.

You can quickly estimate your Iowa State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Iowa and. Include your income deductions and credits to calculate. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Ad Access Tax Forms. Use Our Free Powerful Software to Estimate Your Taxes. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Simply select your tax filing status and enter a few other details to estimate your total taxes.

Interest is not charged on penalty. Client Login Create an Account. For tax year 2019 the standard deduction is.

Read across to the column marked Your Tax Is Enter the amount on line 39. Based on your projected tax withholding for the year we then show you your refund or. In addition to the exemption provisions above if you were a nonresident or part-year resident and had net income.

Using the tax tables determine the tax on the taxable income from line 38 of the IA 1040. Ad Enter Your Tax Information. Calculate tax separately and combine the amounts 5.

State Tax Tables for 2019 displayed on this page are provided in. Use the PriorTax 2019 tax calculator to find out your IRS tax refund or tax due amount. The state-level income tax rate ranges from 033 to 853 and residents of Appanoose county need to pay 1 local income tax.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Your total tax liability for the year is 2000.

States Without Sales Tax Article

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Wait California Has Lower Middle Class Taxes Than Texas Bloomberg

State Corporate Income Tax Rates And Brackets Tax Foundation

Hawaii Income Tax Hi State Tax Calculator Community Tax

Do I Have To File State Taxes H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

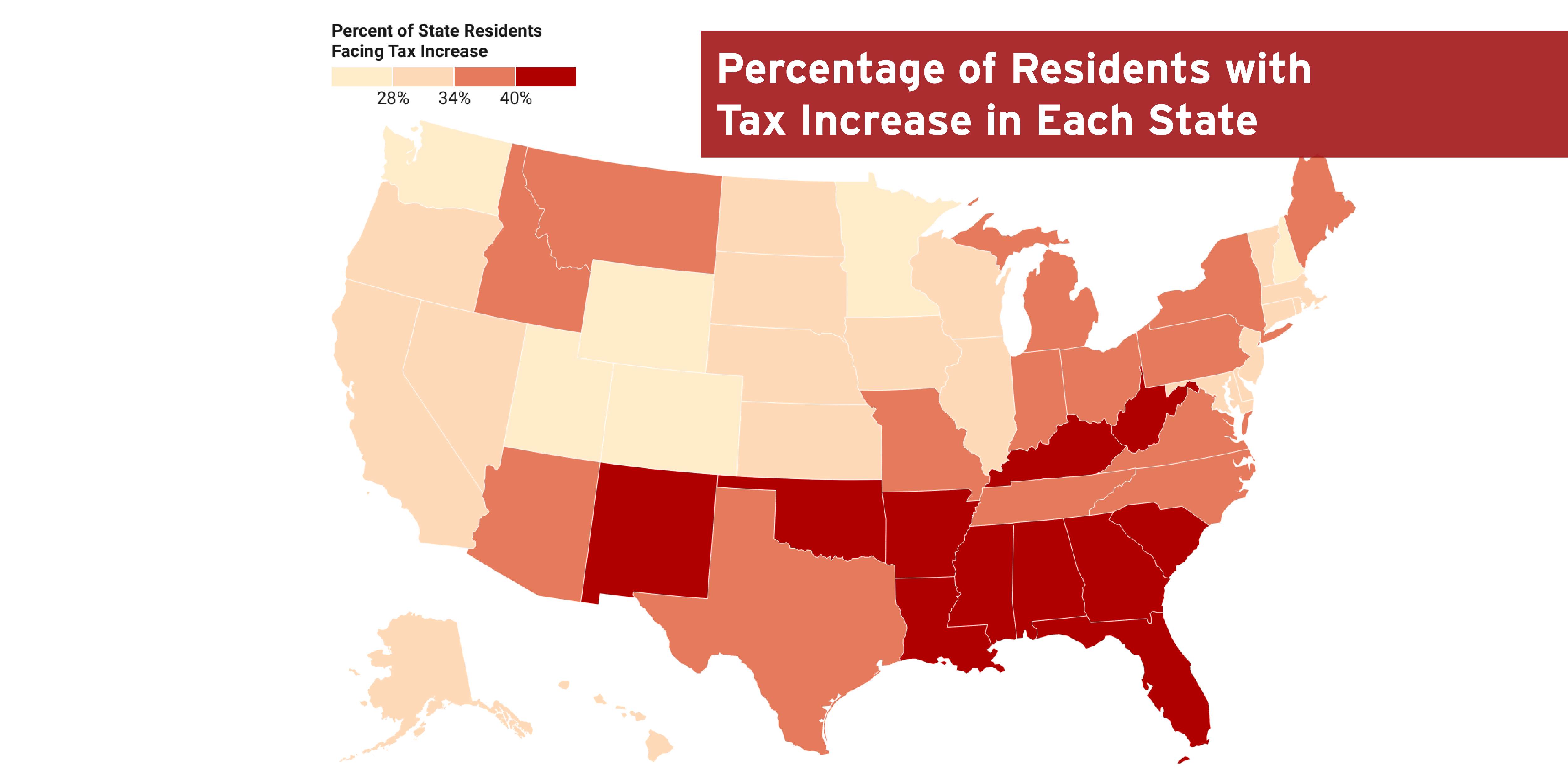

How The Tcja Tax Law Affects Your Personal Finances

Tax Calculator Estimate Your Taxes And Refund For Free

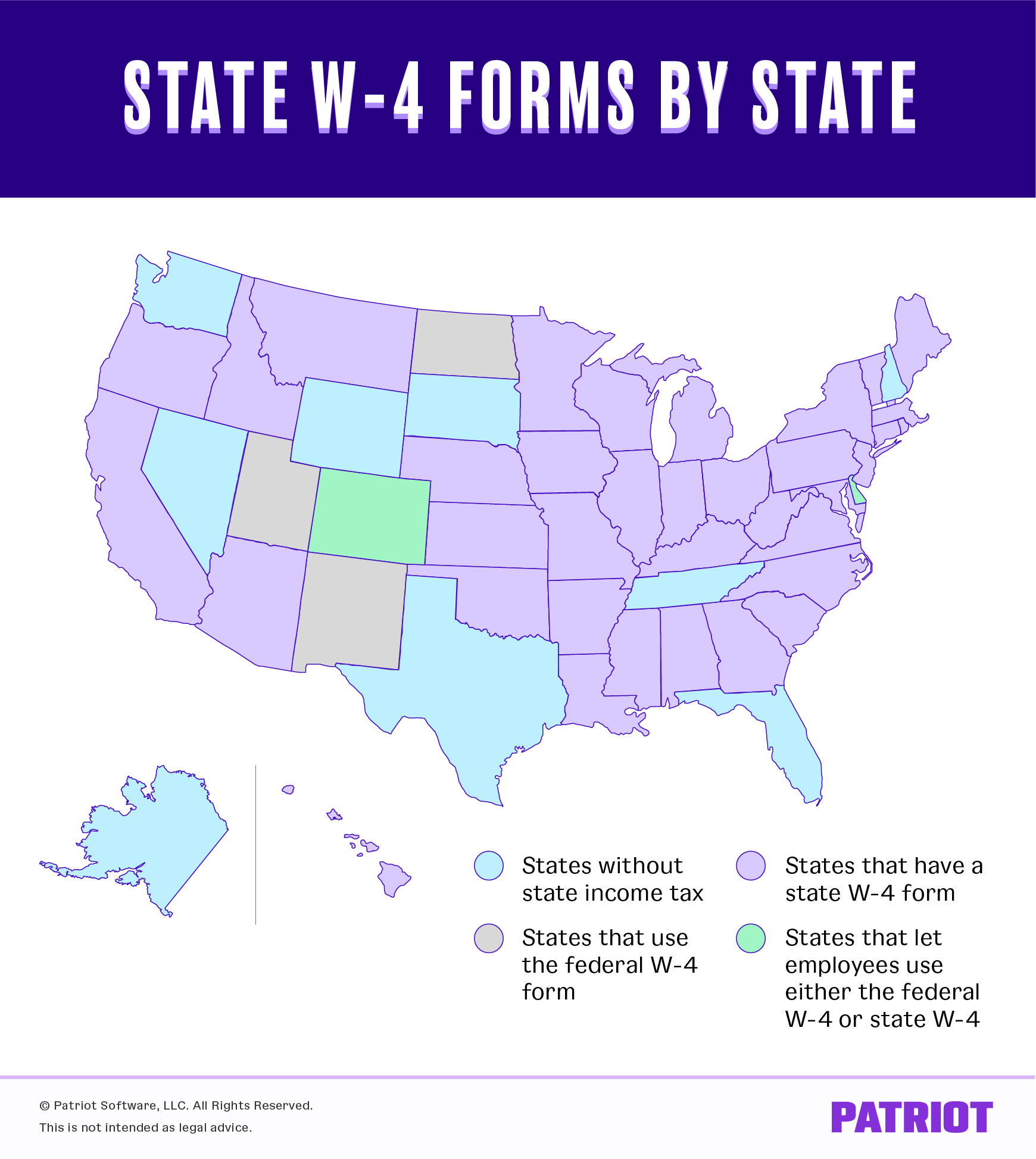

State W 4 Form Detailed Withholding Forms By State Chart

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Fixed Deposits Interest Rates 2019 Interest Rates Deposit Finance

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)